People's Bank Reports Earnings for 3rd Quarter

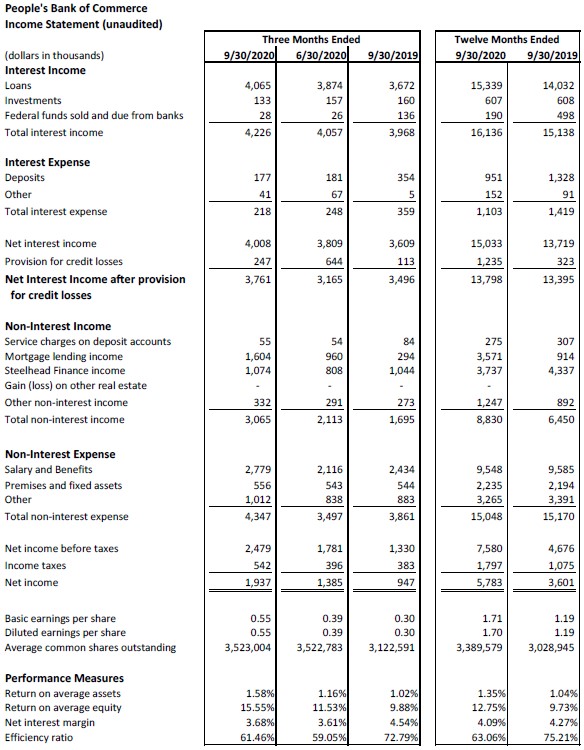

Medford, Oregon - People’s Bank of Commerce (OTCBB: PBCO) announced today its financial results for the third quarter and year-to-date 2020. The bank reported net income of $1,937,000 or $0.55 per basic and diluted share for the third quarter of 2020, compared to net income of $947,000 or $0.30 per share in the same quarter of 2019. Earnings for the first nine months of 2020 totaled $4,433,000 or $1.28 per share compared to $2,719,000 or $0.89 per share during the first three quarters of 2019. Earnings per share for the trailing 12 months ending September 30, 2020 were $1.71 per share compared to $1.19 during the same period one year earlier.

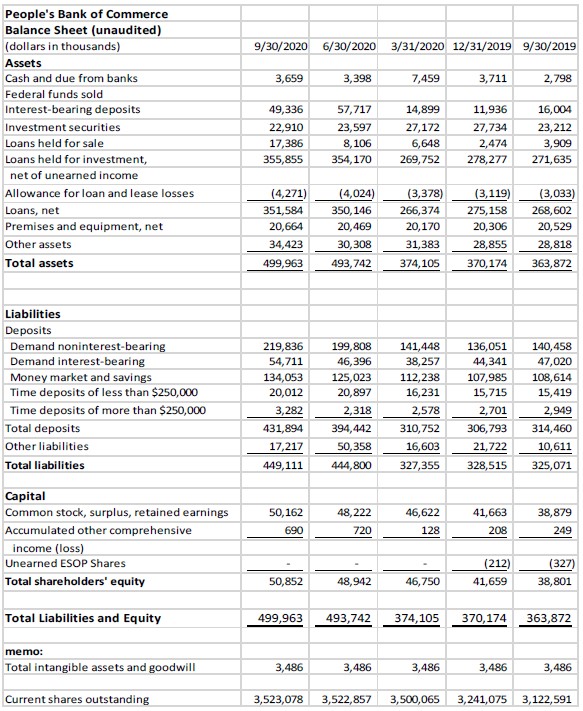

Balance sheet September 30, 2020 vs. September 30, 2019:

- Total Loans increased 35%

- Total Deposits increased 37%

- Total Assets increased 37%

- Total Equity increased 31%

Income statement year-to date September 30, 2020 vs. September 30, 2019:

- Net-interest Income increased 10%

- Pre-tax income increased 56%

- Mortgage lending income up by 308%

- Non-interest Income increased 44%

- Non-interest Expense increased 1%

CEO’s Comments

“Over five years ago the bank created a strategic plan that focused on the development of non-interest income that would stabilize the bank’s earnings during periods of low interest rates. Today we are seeing the benefits of that strategy as interest rates are again at all-time lows. While low rates are detrimental to our overall net interest income after provision, up only 1% over the same period in 2019, they do enhance the income potential of our Home Lending Department. The bank’s factoring company, purchased in 2017, is also contributing good, consistent non-interest income, even considering the pandemic shutdown in April and May of this year. The Paycheck Protection Program (PPP) processing fee income also contributed to a very strong first nine months of 2020. Total loan growth, excluding PPP loans, has been very soft through the 3rd quarter of 2020, while deposits are up 37%, some of which can also be attributed to PPP,” stated Ken Trautman, People’s Bank CEO.

“Last year I said that 2019 had been a year of change for the bank, which included a core processing conversion as well as staff reductions in our branch system due to improved technology and processing centralization. The year 2020 has been a year of adaptation as we navigate through the COVID-19 reality, face devastating wildfires and wait for a return to normalcy,” added Trautman.

“The year’s unique circumstances of increased fee income due to the pandemic has enabled the bank and its employees to substantially contribute to the rebuilding of the Rogue Valley community after the tragic fires which displaced nearly 3,000 families,” commented Trautman. “Through a donation to the People’s Bank of Commerce Foundation of more than $1.2 million, the bank and its employees are proud to support the newly formed Southern Oregon Housing Initiative. This collaboration of community businesses and partners is diligently working to develop solutions for intermediate and long-term housing for fire victims.”

Provision for Credit Losses

The bank’s year-to-date provision for loan and lease losses was $1.2 million compared a provision of $211 thousand during the same period last year. This increase was a hedge against the unknown credit issues that could arise because of the COVID-19 pandemic. In spite of COVID-19, credit quality remains strong with no loans past due over 90 days or on non-accrual at September 30, 2020, consistent with the same time in 2019. At the end of the third quarter 2020, the loan loss reserve for portfolio loans, excluding PPP loans, was 1.56% compared to 1.12% at the end of the third quarter 2019.

Non-Interest Income

For the quarter ending September 30, 2020, non-interest income was $3.1 million compared to $1.70 million in the same quarter one year earlier. For the first three quarters of 2020, non-interest income was significantly higher than the previous year with $7.1 million compared to $4.9 million year-to-date in 2019. The bank’s home lending division generated $3.1 million in non-interest income while Steelhead Finance, the bank’s factoring division, generated $2.8 million during the three quarters of 2020.

Non-Interest Expense

For the quarter ending September 30, 2020, non-interest expense was $4.3 million compared to $3.9 million in the same quarter of 2019. Year-to-date non-interest expense totaled $11.6 million through September 30, 2020, compared to $11.4 million in the same period the prior year.

Capital

As of September 30, 2020, shareholder’s equity totaled $50.9 million, compared to $38.8 million at September 30, 2019. The bank’s Tier 1 capital ratio was 9.40% at the end of the third quarter 2020, compared to 9.73% one year ago. Tangible Book value per share was $13.25 on September 30, 2020, compared to $11.23 on September 30, 2019.

About People’s Bank of Commerce

People’s Bank of Commerce’s stock trades on the over-the-counter market under the symbol PBCO. Additional information about the Bank is available in the investor section of the bank’s website at: www.peoplesbank.bank.

Founded in 1998, People’s Bank of Commerce is the only locally-owned and managed community bank in Southern Oregon. People’s Bank of Commerce is a full-service bank headquartered in Medford, Oregon with branches in Medford, Ashland, Central Point, Grants Pass and Klamath Falls.

"Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995:

This release includes forward-looking statements intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified by phrases such as People’s Bank or its management "believes," "expects," "anticipates," "foresees," "forecasts," "estimates" or other words or phrases of similar import. Similarly, statements herein that describe People’s Bank’s business strategy, outlook, objectives, plans, intentions or goals also are forward-looking statements. All such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those in forward-looking statements.