People's Bank Year-To-Date Earnings Per Share Increase 24%

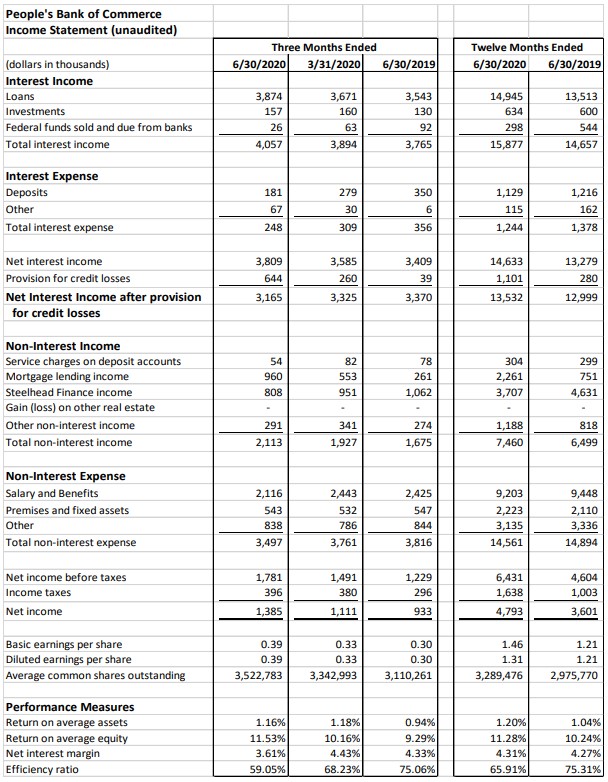

Medford, Oregon - People’s Bank of Commerce (OTCBB: PBCO) announced today its financial results for the second quarter and year-to-date 2020. The bank reported net income of $1,385,000 or $0.39 per basic and diluted share for the second quarter of 2020, compared to net income of $933,000 or $0.30 per share in the same quarter of 2019. Earnings for the first six months of 2020 totaled $2,496,000 or $0.72 per share compared to $1,772,000 or $0.58 per share during the first half of 2019. Earnings per diluted share for the trailing 12 months ending June 30, 2020 were $1.46 per share compared to $1.21 one year earlier.

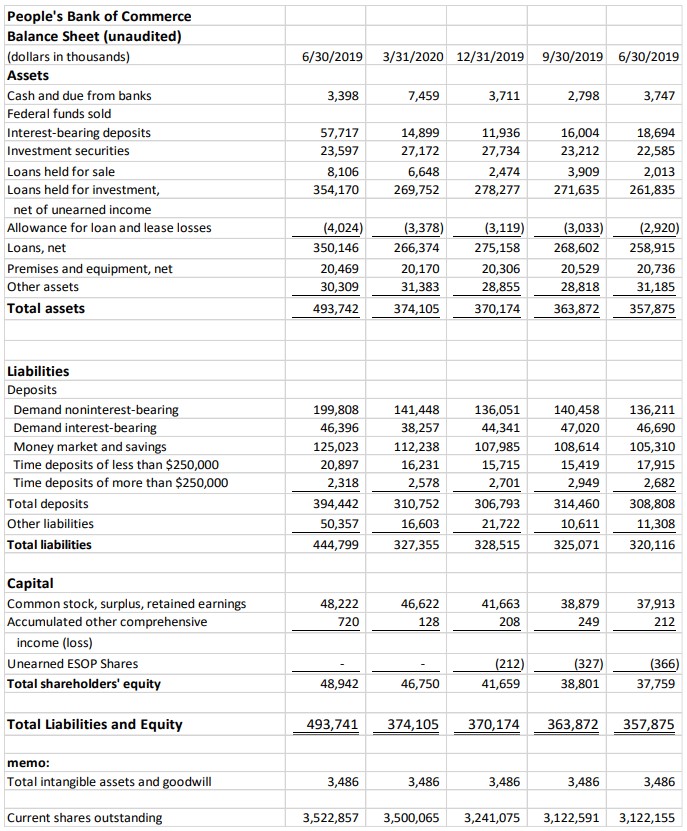

Balance Sheet June 30, 2020 versus June 30, 2019:

- Total Loans increased 37%, PPP loans accounted for 94.8% of the total increase

- Total Deposits increased 28%

- Total Assets increased 38%

- Total Equity increased 30%

- Year to Date Return on Average Assets as of June 30, 2020 was 1.17%

- Year to Date Return on Average Equity as of June 30, 2020 was 10.88%

Income Statement year-to date June 30, 2020 versus June 30, 2019:

- Net-interest Income before the provision for losses increased 9%

- Pre-tax income increased 40%

- Non-interest Income increased 25%

- Non-interest Expense decreased 4%

CEO’s Comments

“Total loans and deposits continued to grow through the first half of 2020, at 37% and 28% respectively, significantly aided by the Paycheck Protection Program (PPP),” stated Ken Trautman, bank CEO. “The Net Interest Margin experienced compression in second quarter, resulting from the bank’s portfolio of PPP loans originated during the quarter with a 1% fixed interest rate,” explained Trautman. “The bank is also receiving strong income from our residential mortgage lending division. Residential mortgage opportunities are expected to continue throughout the balance of this year based on the continued low home loan rates.”

Provision for Credit Losses

Mr. Trautman continued, “Credit quality remains strong with no loans past due over 90 days or on non-accrual at the end of June 2020. Although problem assets have not materialized as a result of the COVID-19 pandemic, the bank has used its strong earnings to build its loan loss reserve for portfolio loans (excluding PPP loans) to 1.46% at the end of the second quarter 2020, compared to 1.12% for the same period in 2019.”

Non-Interest Income

For the quarter ending June 30, 2020, non-interest income was $2.1 million compared to $1.7 million in the same quarter one year earlier. For the first half of 2020, non-interest income was $4.0 million compared to $3.2 million year-to-date in 2019. The bank’s Steelhead Finance Division generated $1.8 million in non-interest income during the first half of 2020, compared to $2.1 million in the same period the prior year, a direct result of the economic slowdown caused by the COVID-19 pandemic. This reduction in Steelhead income was completely offset by the significant increase in income generated by our Residential Lending Division, which produced $1.5 million in income during the first half of 2020 compared to $471 thousand in income for the same period last year.

Non-Interest Expense

For the quarter ending June 30, 2020, non-interest expense was $3.5 million compared to $3.8 million in 2019. Year-to-date non-interest expense totaled $7.3 million through June 30, 2020, compared to $7.6 million in the same period the prior year. Mr. Trautman explained, “The most significant item impacting non-interest expense during 2020 was salary expense, which decreased 5%, the result of operating efficiencies gained by improved digital platforms and centralization of duties, as well as expense offsets recognized from PPP processing fees.”

Capital

As of June 30, 2020, shareholder’s equity totaled $49 million, compared to $38 million at June 30, 2019. Five million of the increase in shareholder equity was the result of the capital campaign completed in the first quarter of 2020, the balance was supported by bank earnings. The bank’s modified Tier 1 Capital Ratio, which excludes Paycheck Protection Program Liquidity Facility (PPPLF) advances, was 9.82% at the end of the second quarter 2020, compared to 9.61% one year ago. Tangible Book value per share was $12.70 at June 30, 2020, compared to $10.91 on June 30, 2019.

About People’s Bank of Commerce

People’s Bank of Commerce’s stock trades on the over-the-counter market under the symbol PBCO. Additional information about the Bank is available in the investor section of the bank’s website at: www.peoplesbank.bank.

Founded in 1998, People’s Bank of Commerce is the only locally owned and managed community bank in Southern Oregon. People’s Bank of Commerce is a full service bank headquartered in Medford, Oregon with branches in Medford, Ashland, Central Point, Grants Pass and Klamath Falls.

"Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995:

This release includes forward-looking statements intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified by phrases such as People’s Bank or its management "believes," "expects," "anticipates," "foresees," "forecasts," "estimates" or other words or phrases of similar import. Similarly, statements herein that describe People’s Bank’s business strategy, outlook, objectives, plans, intentions or goals also are forward-looking statements. All such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those in forward-looking statements.