People's Bank Reports 2021 Earnings

Medford, Oregon - People’s Bank of Commerce (OTC PINK: PBCO) announced today its financial results for the 4th quarter and year-ended 2021.

Highlights

- Fourth quarter net income of $3.0 million, or $0.59 per diluted share

- Year-to-date net income of $11.5 million, or $2.44 per diluted share

- Quarterly non-PPP loan growth rate of 13.1%, year-to-date loan growth of 68.8%

- Fourth quarter tax equivalent net interest margin of 3.46%, excluding factoring revenue

- Steelhead factoring revenue increased 60.1% over Q4 2020

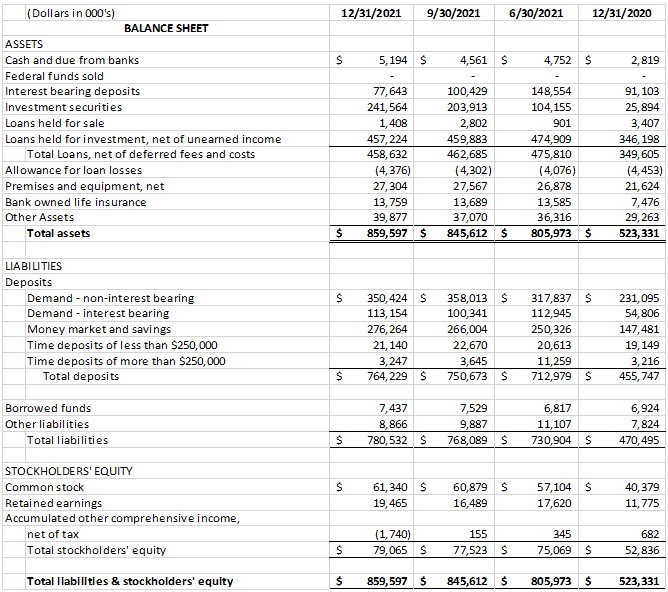

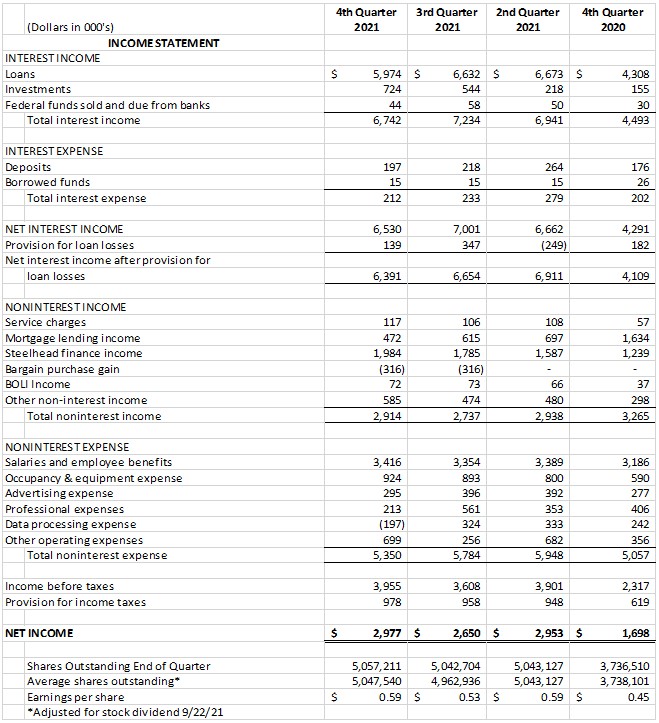

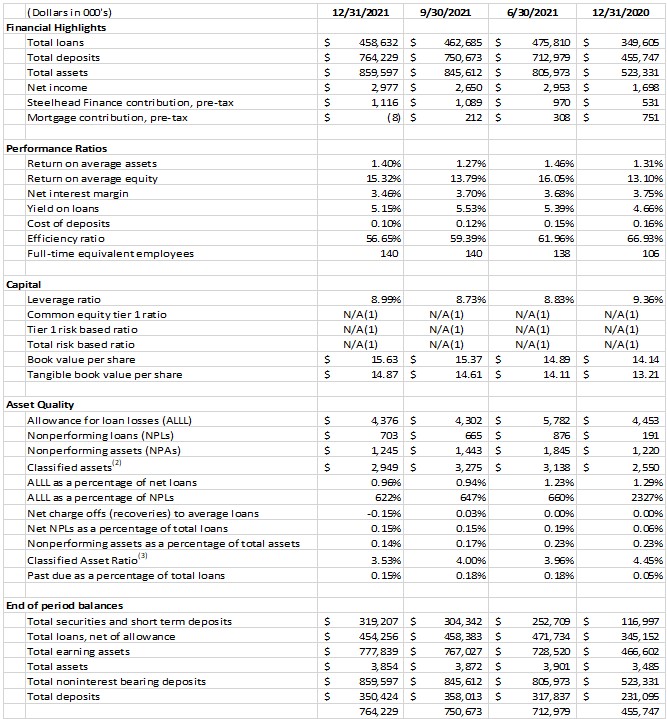

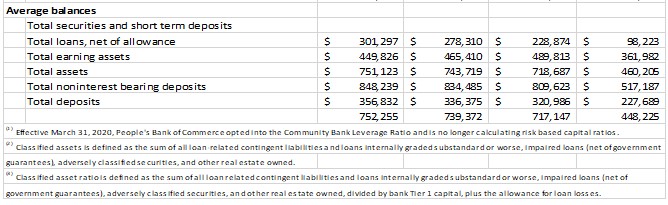

People’s Bank reported quarterly net income of $3.0 million, or $0.59 per diluted share, for the 4th quarter of 2021 compared to net income of $1.7 million, or $0.45 per diluted share, in the same quarter of 2020. The bank recognized year-to-date net income of $11.5 million versus $6.1 million for the twelve months of 2020, an 87.1% increase from the prior year. Earnings per share for the trailing 12 months were $2.44 per share, up from $1.72 per share for the same period of 2020, a 41.9% increase. Fourth quarter income continued to be positively impacted by PPP fee income due to pro-ration of the remaining unamortized origination processing fees at payoff with $637 thousand in PPP fee income recognized during the quarter. Steelhead Finance also demonstrated solid revenue of $2.0 million during the quarter, versus $1.2 million in 4th quarter 2020. During the quarter, the bank made a provision for loan losses of $139 thousand. As anticipated with the bank’s recent acquisition of Willamette Community Bank (WMCB) in the 1st quarter 2021, the bank was able to achieve higher earnings per share than in previous periods.

During the quarter, deposits increased $13.6 million, or an annualized 7.2% growth rate. On an annual basis, deposits grew by $308 million, a 67.7% increase from December 31, 2020. Deposit growth during the year was attributed to several factors, including the bank’s acquisition of WMCB in the first quarter, the bank’s participation in the PPP loan program, and organic growth in all deposit markets. “We continue to see deposit growth, although at a slower pace than previous quarter. Our focus on building and sustaining relationships forged during the PPP push has allowed us to not only grow but retain core deposits,” commented Joan Reukauf, Chief Operating Officer.

The Bank continued to deploy excess liquidity to the investment portfolio as an alternative to deposits at the Federal Reserve Bank. Through the end of the quarter, the bank increased its investment portfolio by $37.7 million, an 18.5% increase from the prior quarter.

Core portfolio loan growth, excluding PPP, totaled $14.3 million during the 4th quarter of 2021, representing an annualized growth rate of 13.1%. For the year 2021, the bank grew portfolio loans, excluding PPP, by $183.7 million, an overall annual growth rate of 68.8% when the impact of the WMCB merger is included. “During 2021, the bank achieved double-digit loan growth, in spite of the continued economic volatility from the COVID-19 pandemic and focus on the Willamette merger,” commented Julia Beattie, President.

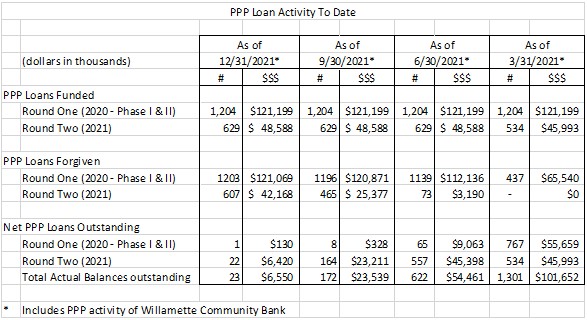

The bank’s active role in the Paycheck Protection Program (PPP) beginning in April 2020 resulted in 1,204 PPP loans in Round I, totaling $121.2 million, with all but 1 of the loans from Round I having been forgiven by December 31, 2021 (includes loans funded by WMCB prior to the bank merger with People’s Bank). Similarly, the bank funded 629 loans in Round II of the Paycheck Protection Program, representing $48.6 million in loan volume. By December 31, 2021, only $6.6 million in Round II loans had yet to be forgiven.

During the quarter, the bank experienced a decrease in classified assets. This was the result of a reduction of Other Real Estate Owned. Total loans past due or on non-accrual were flat from the prior quarter at 0.15%. During the 4th quarter, the Allowance for Loan and Lease Losses (ALLL) was updated based on new loan growth achieved during the quarter and updated economic expectations, which were factored into the bank’s analysis. As of December 31, 2021, the ALLL was 0.92% of portfolio loans excluding PPP and the unallocated reserve stood at $0.6 million or 14.6% of the allowance.

As of December 31, 2021, the bank’s Tier 1 Leverage Ratio was 8.99% versus 9.36% as of the same date in 2020, with total shareholder equity of $79.1 million. During the quarter, the bank was able to augment capital through earnings while assets also increased with our growth in deposits.

Fourth quarter 2021 non-interest income totaled $2.9 million, a decrease of $351 thousand from the 4th quarter of 2020. During the quarter, Steelhead Finance factoring revenue increased $745 thousand, a 60.1% increase over the same quarter of 2020. Conversely, mortgage income decreased $1.1 million, or a 71.1% from the 4th quarter of 2020. “The 4th quarter was the strongest on record for Steelhead Finance, we are extremely pleased with the division’s results during 2021,” commented Ken Trautman, CEO. “Residential Mortgage lending was soft in the 4th quarter, but we have increased our focus in the Willamette region to continue diversifying our revenue streams bank-wide,” added Trautman. During the year, the bank also updated its bargain purchase gain from the WMCB merger of $2.3 million to reflect the anticipated tax consequences, resulting in a reduction to other non-interest income of $317 thousand in both the third and fourth quarter of 2021.

Non-interest expense totaled $5.4 million in the 4th quarter, down $434 thousand from the 3rd quarter of 2021. During the 4th quarter, the bank reversed $425 thousand in one-time expense accruals from our recent merger, primarily the result of lower-than-expected deconversion costs from Willamette’s former data processing vendor. Included in 2021 non-interest expense is the final quarterly accrual of $250,000 for the bank’s $1 million donation to fire relief to assist with intermediate and long-term housing needs as our Southern Oregon community rebuilds. This is a non-recurring item for 2021. For the twelve months ending December 31, 2021, excluding one-time merger adjustments, earnings per share would have been $2.57, versus $1.72 for the same period ended December 31, 2020.

About People’s Bank of Commerce

People’s Bank of Commerce’s stock trades on the over-the-counter market under the symbol PBCO. Additional information about the Bank is available in the investor section of the bank’s website.

Founded in 1998, People’s Bank of Commerce is the only locally owned and managed community bank in Southern Oregon. People’s Bank of Commerce is a full-service, commercial bank headquartered in Medford, Oregon with branches in Albany, Medford, Ashland, Central Point, Grants Pass, Klamath Falls, Lebanon, and Salem.

"Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995:

This release includes forward-looking statements intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified by phrases such as People’s Bank or its management "believes," "expects," "anticipates," "foresees," "forecasts," "estimates" or other words or phrases of similar import. Similarly, statements herein that describe People’s Bank’s business strategy, outlook, objectives, plans, intentions or goals also are forward-looking statements. All such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those in forward-looking statements.